Checkout the ways to Pay Income Tax through Credit Card in India – Income Tax has made the online tax payment easier with activation of Credit Card through Payment Gateway. Now, all the Income Tax payers can make payment of Income Tax, Advance Tax and TDS through Credit Cards seamlessly with lower transaction charges. Checkout the step by step process to pay the taxes through Credit Card via PG of Canara Bank, Federal bank & Kotak Mahindra Bank.

Steps to Pay Income Tax through Credit Card

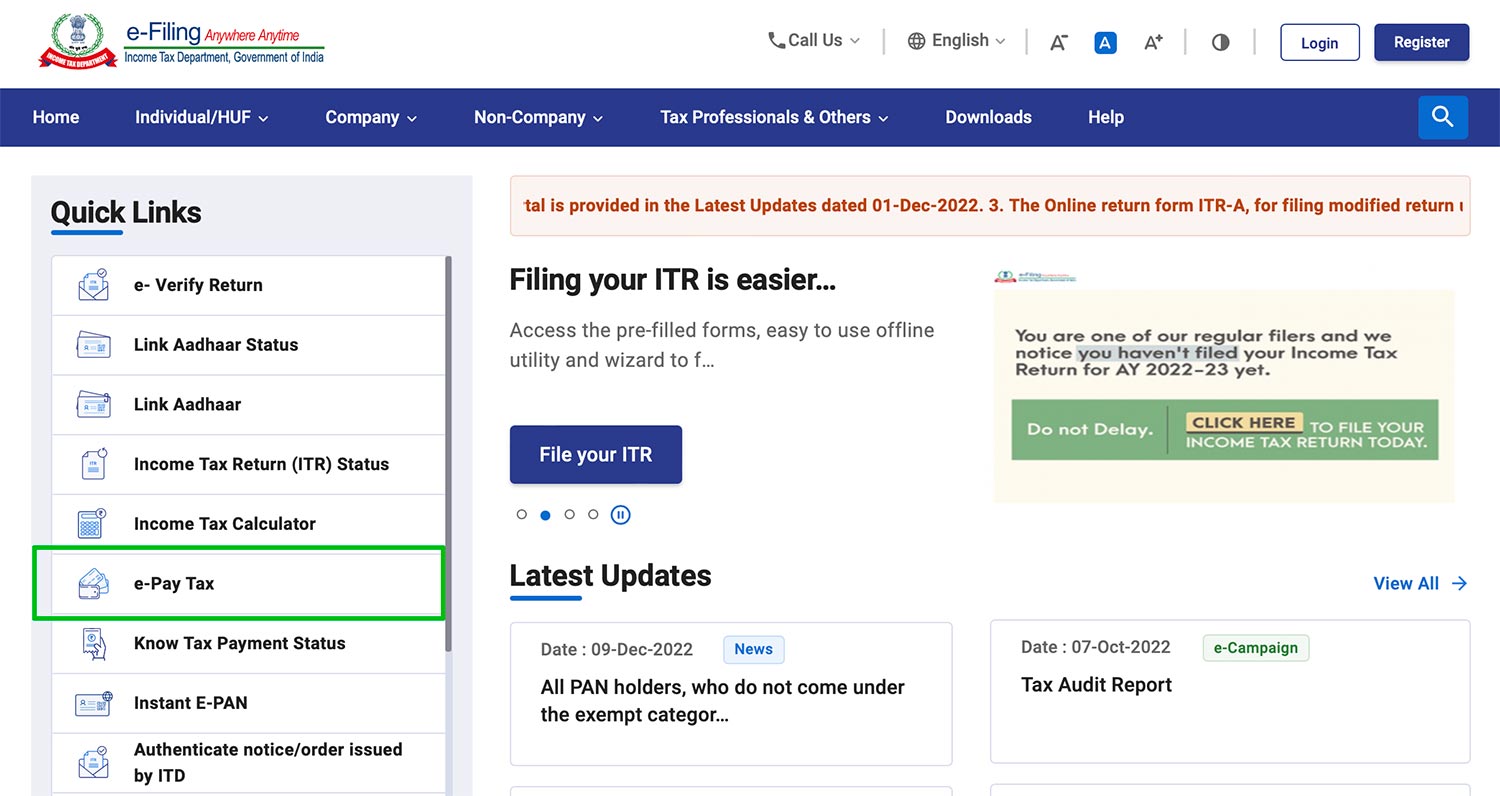

- Visit the Income Tax efilling portal or Click on IncomeTax eFiling Portal

- Under Quick Link, Go to “e-Pay Tax” section

- Enter your PAN Number

- An OTP will be sent on the registered mobile number

- Validate the OTP

- Choose type of tax, then select FY/AY & other details

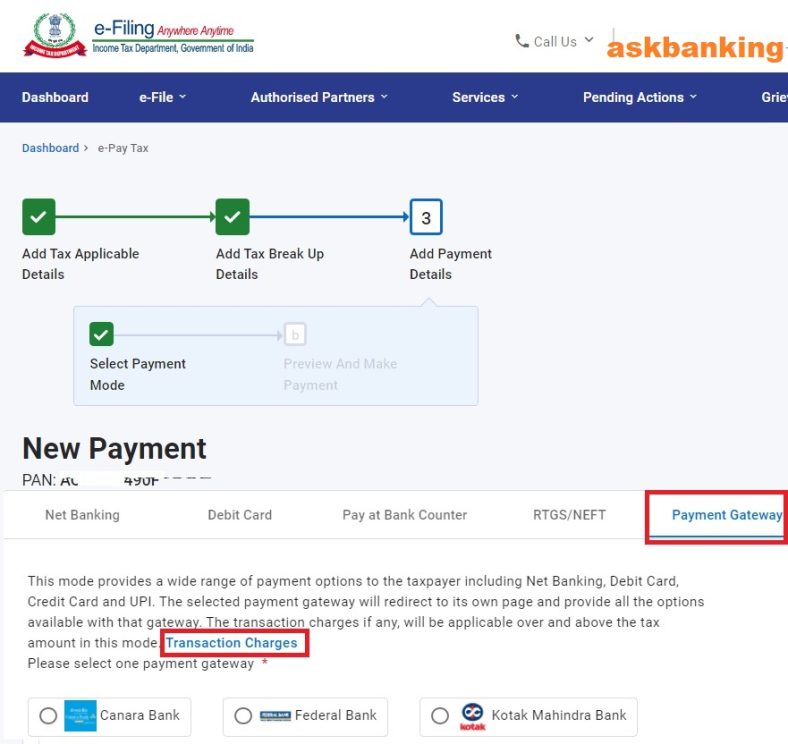

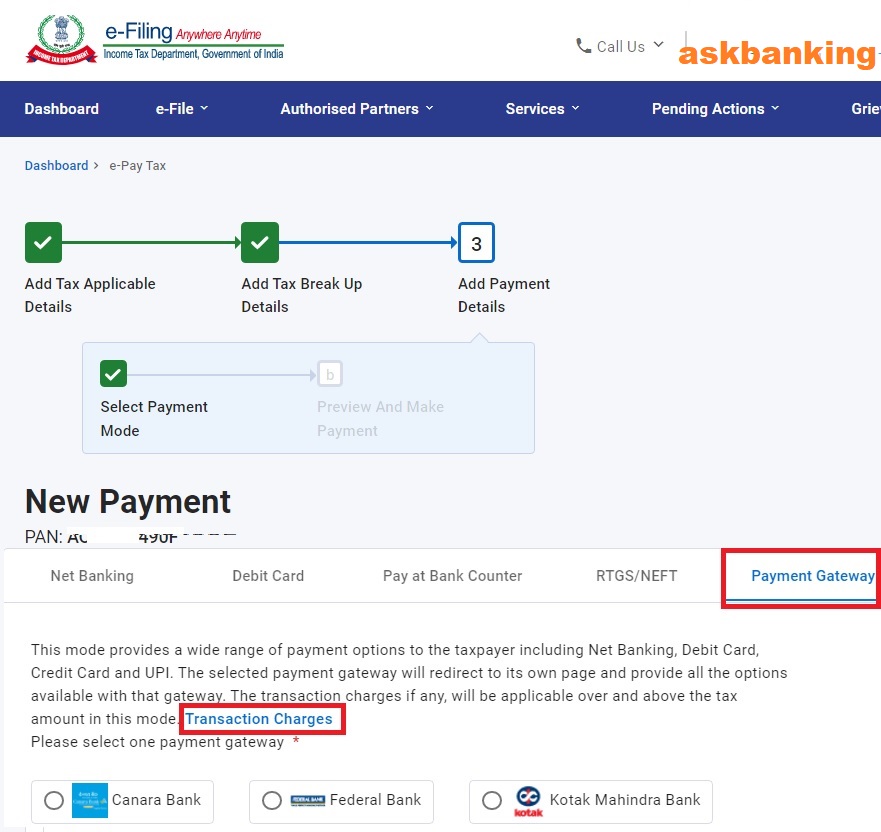

- Choose the Option “Payment Gateway”

- Select the Bank PG out of three for making payment through Credit Card

- Make the final payment

Transaction Charges for Credit Card Payment

There are transaction charges for making the payment through the Credit Cards. There are three banks which are offering the Credit Card transactions i.e. Canara Bank, Kotak Mahindra Bank & Federal bank. Paying taxes through Canara Bank is the cheapest with only 0.47% transaction fees without GST.

The charges for processing the credit Card transactions are:

Canara Bank Payment Gateway Charges

For Canara Bank Credit Card Holders : 0.47% of the Transaction amount + GST@18%

For Others – 0.47% of the Transaction amount + GST@18%

Don’t have Canara Bank Credit Card – Check Canara Rupay Select Credit Card Review

Kotak Mahindra Payment Gateway Charges

For Credit Card of any bank : 0.80% of the Transaction amount + GST@18%

International Cards – 2.75% of the Transaction amount + GST@18%

Federal Bank Payment Gateway Charges

For Federal Bank Credit Card Holders : 0.85% of the Transaction amount + GST@18%

For Others – 0.85% of the Transaction amount + GST@18%

Benefit of Paying Income Tax Through Credit Cards

There are numerous benefits of paying the Income Tax through Credit Cards. The major benefits are in term of Rewards, Credit period of 50 days and transaction volume on the cards for reaching the annual fees waiver limit.

Leave a Comment