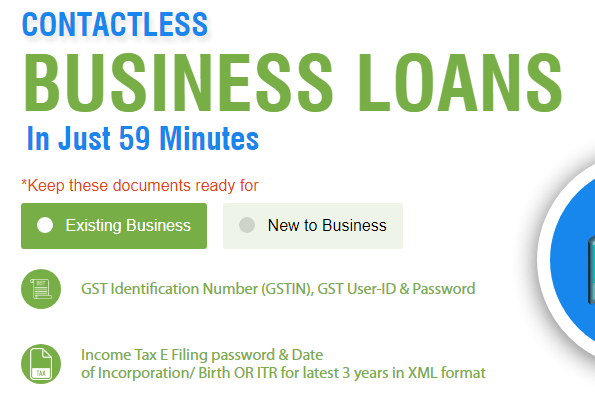

The finance ministry has directed all the Public Sector Banks (PSBs) to create a common MSME loan product with integrated features and common documentation for loan requested through new initiative www.psbloansin59minutes.com. Any Indian citizen may get approval for MSME loan upto Rs One Crore via this portal in 59 minutes. The facility is available for businesses that submit GST and income tax details, along with their bank statements, for speedier loan sanctions. The loan will be disbursed within eight days.

Click – MSME Loan EMI Calculator

Further, banks were also asked to standardize loan processes and products for micro, small and medium enterprises (MSMEs) for securing the promise of approving them within an hour. This common loan product will be having option to offer variations, enabling small businesses to meet their term loan and working capital needs through an online platform that will be contactless.

www.psbloansin59minutes.com portal had seen over 1 lakh hits but the number of approvals was not high. It is also informed that nearly two-thirds of the loan request are for startup under 35 years of age group.

Major Reason for Low approval for loan requested through www.psbloansin59minutes.com

- There were issues related to debt-equity ratio and the number of years for which tax returns had to be submitted.

- Startup and new companies doesn’t have any backup supportive documents

- Not meeting the credit policy mandatory requirements like debt-equity ratio, debt-to-income-ratio etc.

It is believe that government has directed banks to relax the credit norms and have been told to offer loans to companies with a debt-equity ratio of 4:1, given that MSMEs typically have a lower equity base. Similarly, these borrowers will need a credit ratio or debt-to-income-ratio of 1:1.

Read – How To Calculate Debt Service Coverage Ratio (DSCR) ?

Though the MSME portal is exclusively for Public Sector banks,private banks like HDFC Bank and ICICI Bank has shown interest. Portal may be opened for private banks also in near future.

Leave a Comment