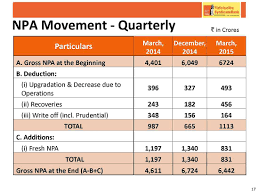

Syndicate Bank is troubling with higher NPA in past few quarters and recent reply by the bank against a RTI query shows that agriculture loans worth Rs 10,253 crore disbursed by Syndicate Bank have turned into non-performing assets (NPAs) in the last five fiscal years until March 2018.

Read – Syndicate Bank National Common Mobility Card (NCMC) Features & Benefits

Total NPA of the bank increased in the last three fiscals, with the bad loans soaring to Rs 3,851 crore in 2017-2018.

The NPA in the agricultural sector was Rs 962 crore in 2013-14, Rs 1,658 crore in 2014-15, Rs 1,536 crore in 2015-16, Rs 2,246 crore in 2016-17 and Rs 3,851 crore in 2017-18.

Read – Review – Syndicate Bank Rupay Select Credit Card

The higher NPA shows that the NPA is not at all limited to Business sector rather the agri NPA is also pinching hard to Banks’ profit.

Leave a Comment