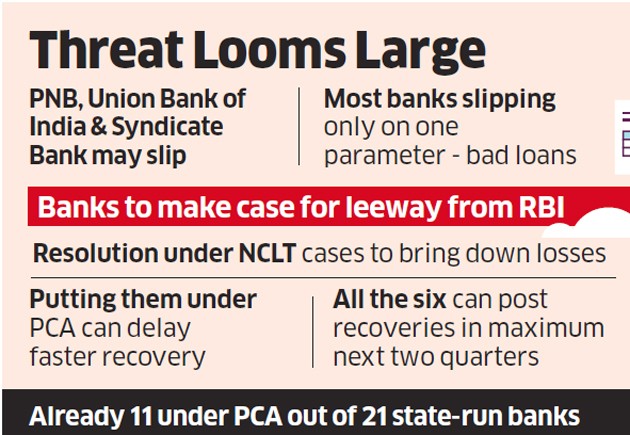

PNB, Syndicate Bank & Union Bank of India may come under RBI’s prompt corrective action (PCA). ET has reported that Reserve Bank of India imposes restrictions on these lenders in the next one month probably by this quarter (30th June).

PCA involves imposition of various restrictions such as branch expansion, halting dividend payments, taking fresh loan proposals and restructuring if warranted. State-owned banks currently under PCA are Allahabad Bank, United Bank of India, Corporation Bank, IDBI Bank, UCO Bank, Bank of India, Central Bank of India, Indian Overseas Bank, Oriental Bank of Commerce, Dena Bank and Bank of Maharashtra.

Click Here – What is Prompt Corrective Action (PCA)

RBI has already imposed PCA restrictions on Allahabad Bank in May, including a directive to reduce exposure to unrated and high-risk advances. Dena Bank was also asked to avoid taking fresh loans.

ET has also reported that finance ministry is not in favor of putting these banks under PCA and may ask banking regulator to give some relief for these lenders as they are not falling behind on all indicators.

Finance Ministry is planning to sell healthy loans of banks and this may halt If the lenders come under PCA.

These banks in various discussions with the finance ministry and also with the RBI have said that they will be able to recover in the next one or two quarters. If the RBI imposes restrictions under PCA, it will be difficult for them to turn around quickly.

Leave a Comment