Easy steps to Open, Canara DiYA – Canara Bank Instant Digital Account Online using Mobile Application ‘DIYA’ or Digitally Your Account.- Syndicate Bank and Canara Bank customers can open the Instant Online Digital Saving Bank account using the bank’s Online or Mobile application called Canara DiYA app. It is the platform introduced by Canara Bank for online account opening for Individuals using PAN and Aadhaar.

Features of Canara Bank Digital Saving Account DiYA

An Instant online process using PAN and Aadhaar to open the Digital Saving Bank account for Individual without visiting the branch. The account number is being activated instantly and ready to use. The account opening process is completely paperless and you don’t have to visit the bank branch to open savings account.

Will the Canara Digital Saving Account be a Zero Balance Account ?

Canara Digital Saving Account will not be a Zero Balance account. The account created online has a minimum average balance. The minimum average balance requirement of the account is Rs.1000 for urban customers and Rs.500 for customers residing in semi-urban and rural areas.

The account will be provided with all the facilities instantly like Internet banking, mobile banking, debit card, cheque book facilities etc.

Individual will be given an option to choose the branch of their choice.

Can I Open Digital Account without PAN card ?

You can open Canara Bank account online without PAN card. This makes it easier for people who don’t have PAN to open a bank account online. Without PAN, customers won’t be able to transact beyond Rs.50,000. Also, after the online account opening process is complete, customers need to visit the nearest bank branch to submit Form 60/61.

What will be the Limit on transactions ?

Online Digital Saving Account will be having the transaction limit of Rs.1 lakh in their account and maximum credit transaction of Rs.2 lakh in a financial year as per RBI guidelines.

Customers need to complete the full KYC of the account within 12 months. Accounts are closed if the full KYC is not completed.

The maximum balance that customers can hold at any point in time in their e-KYC account is Rs.1 lakh.

The aggregate of all credits should not exceed Rs.2 Lakhs in a financial year.

Documents required to open Canara Bank account online

Aadhaar card and PAN card are required to open Canara Bank account online.

Individuals who don’t have PAN card can also open their bank account online post submission of Form 60/61.

How to Open Canara DiYA – Canara Bank Instant Digital Account Online ?

An easy step by step process to open Canara Bank Instant Digital Saving Account online. Individual needs to download the DiYA app or can open through web browser.

Step 1: Download the Canara Diya app for Android or click here to start the online account opening process through web browser.

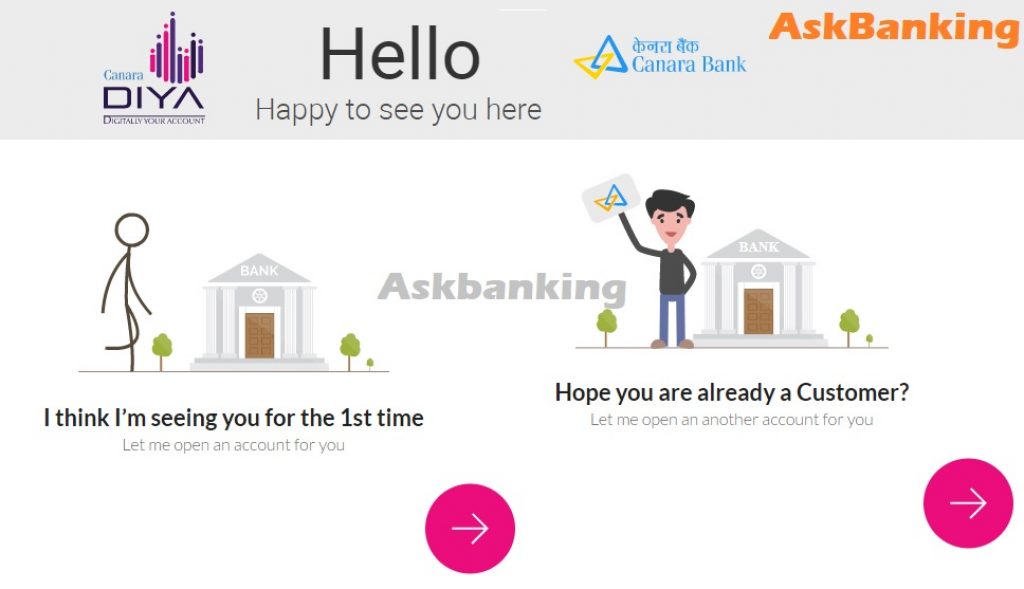

Step 2: If you are opening Canara Bank account for the first time, click on ‘I think I’m seeing you for the 1st time’.

Step 3: Enter your Aadhaar number, agree the terms and conditions and tap on ‘Verify’ to proceed.

Accept the terms and conditions including FATCA declaration which is for an Indian resident citizen, click on ‘I agree’. Enter the OTP that you have received on your registered mobile number.

Step 4: Your basic details including your name, Aadhaar address will be fetched from Aadhaar database.

Step 5: If your communication address is different from Aadhaar address, you can add your communication address.

Step 6: Choose if you want to proceed with your PAN card or without your PAN card. If you don’t have PAN card, click on ‘I don’t have PAN’ and if you have PAN, click on ‘I have PAN’. People who don’t have PAN should submit their form 60 to the nearest bank branch.

If you have PAN, enter your PAN and click on verify to continue.

Step 7: Provide your Passport number, voter id number if available but not mandatory. Add your profession and income.

Step 8: Choose the Digital Banking services opted for like debit card, internet banking etc. Add your father’s name, mother’s name and nominee details. Select your branch, state, search for the nearest bank branch.

Step 9: Add your mobile number and email id to register with the bank account. Enter the OTP that you have received on your mobile number. Click on ‘Open Account’.

Also Read – Canara Bank Cash Deposits Charges Over Rs 50,000

Congrats ! Your account is now open and you will receive your account details such as account number and branch on the screen as well as on email and through SMS message.