How To Calculate Debt Service Coverage Ratio (DSCR) ? – Debt service coverage ratio (DSCR) a very important rile for assessment in giving loan to any firm, individual etc which is calculated to measure potential borrower’s debt.This is sometime also known as Debt service ratio (DSR).

It is most reliable tool used by almost all the finance, banking or mortgagors to determine the repayment capacity of the firm, i.e. if the firm’s income is sufficient to service the debt.

Read Also : How To Calculate Loan to Value ratio LTV / LCR ?

How Do DSCR Analysed ?

The outcome of DSCR ratio helps lending institution or Mortgagors to measures a company’s ability to service its total debt service obligations from their net operating income. In simple term DSCR calculates the ratio between company’s available cash with its current interest, principle, and sinking fund obligations.

The DSCR is very much important for mortgagors in analyzing the projected balancesheet where the assumption are made on future income particularly Interest serving portion. Hence, the debt service coverage ratio is important to both creditors and Debtor, but creditors most often analyze it.

Before processing loan, lender keen to know the cash position of the borrowers like current or future debt position or available cash to pay the current and future debt.

The Debt Service Coverage Ratio (DSCR) consider all the debt including expenses i.e. interest expense, fund obligation etc.

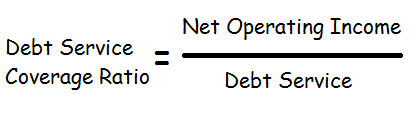

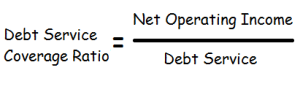

Formula to Calculate Debt Service Coverage Ratio (DSCR)

There is an universal formula to calculate Debt Service Coverage Ratio (DSCR), i.e. dividing net operating income by total debt service.

Where the Net Operating Income is calculated as Annual Net Income + Interest Expense + Depreciation + Other discretionary and non-cash items, it means all the cash flows left after calculating all the operating expenses.This is generally called earnings before interest and taxes or EBIT.

Total Debt service is sum total of all the cost needed to serve the debt. This is sum total of Annual principal and interest payments or Installment (Interest + Principal repayment) + Lease Rental if any available.

DSCR is also be calculated as :

| DSCR | = | PAT + Interest + Lease rental + Non cash expenses |

|

Installment (Interest + Principal repayment) + Lease Rental |

Where PAT is the Profit after Tax which can be extracted from the Profit and Loss statement. other parameters are

- Non cash expenses: Non cash expenses are those expenses which are charged to the profit and loss account for which payment has already been done in the past years. Following are the non cash expenses:

- Writing off of preliminary expenses, pre-operative expenses etc,

- Depreciation on the fixed assets,

- Amortization of the intangible assets like goodwill, trademark, patent, copyright etc,

- Provisions for doubtful debts,

- Deferment of expenses like advertisement, promotion etc.

- Installment amount: In general term the EMI or equated monthly installment of the loan considered or already paying.It includes the payment towards principal and interest for the financial year.

- Lease Rental: The amount of lease or rent paid or payable for the financial year.

How Does Mortgagor finance based on DSCR ?

An important question , how does lender or mortgagor finance based on DSCR ratio. What would be the maximum or minimum level of DSCR consider while financing.

Net Operation income is directly proportional to DSCR, More the DSCR better the firm’s ability to maintain its current debt levels. Hence,a higher ratio is always favorable. More the ratio better the income available to pay for debt servicing.

Read : Calculate Fixed Obligation to Income Ratio (FOIR) in Loans ?

For example, If DSCR ratio is 0.90 it means, company is generating only 90% percentage of income to serve the total debt of 100%. Hence, in long term company might have the problem of debt servicing out of their net income.Ideally the DSCR of greater than one is required. Companies having DSCR of grater than one are better to pay their debt obligations on time.

DSCR Calculator

1 Comment